Many small businesses require financing for various business needs and goals. One of the most expensive needs is business equipment, such as computers, machinery, tools, etc. Fortunately, many equipment financing options exist. Clicklease is an equipment financing company that specializes in fast approvals. However, it might not be the right fit for every small business. This Clicklease review explores the benefits, drawbacks, and application process to help you decide if it’s right for your business. Specifically, we’ll answer these questions and more:

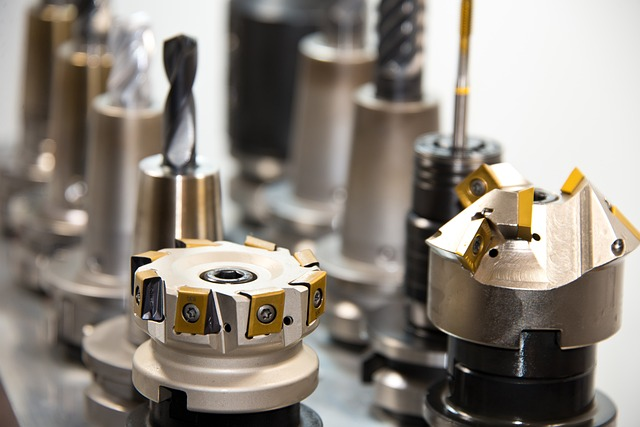

Clicklease LLC is a financial services company that specializes in using technology to provide equipment leasing solutions for small businesses. It offers various products, such as lease-to-own options for equipment like computers, office furniture, and machinery. Clicklease was founded in 2018 and is based in W Valley City, UT. The company has grown rapidly since its inception, catering to the needs of small and medium-sized businesses looking for flexible financing options for their equipment purchases. It has around 200 employees in Utah and Costa Rica.

Clicklease primarily focuses on providing equipment vendors with a financing option to close more sales. Small business owners can complete an application on the Clicklease website, but the company refers business owners to an equipment vendor that supplies their needed machinery.

The company’s equipment lease product is lease-to-own, meaning the business will own the equipment at the end of the lease term. This could be reflected in higher monthly payments and a low purchase price at the end of the term or a lower monthly payment with the option to purchase at market value.

Submitting a lease application to Clicklease involves providing business credit information and undergoing bank verification. This step ensures that the applicant’s financial background aligns with the financing requirements.

Clicklease stands out by offering instant approvals for equipment financing, making the approval decision process quick and efficient. This feature benefits businesses by providing them with timely access to the funds they need.

The registration process with Clicklease is straightforward. It includes signing lease agreements and selecting a purchase option for the equipment being financed. This flexibility allows businesses to choose a payment structure that suits their needs.

Businesses needing assistance during the application process or with questions about lease payments can easily reach out to Clicklease. The company provides support and guidance to ensure a smooth and transparent financing experience for its customers.

Clicklease doesn’t set minimum qualifications for time in business, credit score, or annual revenue. Some online reviews suggest borrowers need a minimum credit score of 520. However, the Clicklease website states all FICO scores are welcome to apply.

The company only performs a soft credit pull when reviewing your application. This means your credit score won’t be affected when you apply.

The company prides itself on quick applications and fast approvals. It states that small business owners can complete the application in under three minutes and receive an approval decision in seconds.

Once the application is approved, the company can fund equipment purchases on the same day. The entire purchase process can sometimes be completed in 10 minutes, per the Clicklease website.

Equipment sellers can offer white-label financing through Clicklease directly on their company website. The process simplifies how small business owners can apply for equipment financing when purchasing from a vendor that works with the company.

However, business owners cannot apply directly to Clicklease. They can fill out a form on the company’s website to receive equipment offers from vendors that work with Clicklease.

Understanding lease agreements is crucial before signing to ensure you comprehend the terms and obligations. Make sure to review all the details carefully. Some online reviews complain about high interest, payment issues, and significant payoff amounts to own the equipment.

Be aware of the lease payment schedule and amounts due. It’s essential to budget accordingly for these expenses.

Familiarize yourself with the purchase options available at the end of the lease term. This knowledge helps you plan ahead and make informed decisions.

The company offers a business loan referral program to help equipment vendors close more sales. However, it doesn’t provide much detail on rates. ISOs and business loan brokers should contact the company for more information.